Crypto arbitrage is a widely used strategy in the crypto markets — even more so than you think. However, pulling it off can be extremely risky. If you miscalculate your risk and purchase volumes, a small difference in price (or a large level of something called a “slippage“) could result in significant losses.

This is why professional crypto arbitrageurs use automated trading bots to spot crypto arbitrage opportunities and execute arbitrage trades quickly and efficiently.

What is crypto arbitrage?

But we’re getting ahead of ourselves. If you don’t know what it is, but so happen to come across this term, you’re on the right page. In this article, we’ll explain what crypto arbitrage is, how it works, and how you could do it “manually” (i.e. without a trading bot).

Crypto arbitrage is basically the strategic buying of crypto assets from one exchange and selling them at another exchange. Of course, to make any profit at all, arbitrageurs must buy the assets for a cheaper price and then selling them for a higher price.

Note that this is different from good ol’ crypto trading. You don’t wait for prices to go up, because arbitrage is literally buying from one market and immediately selling them in another for a higher price.

Take, for instance, the contrast between Bitcoin prices on Binance Exchange and on Coinbase. If Binance lists Bitcoin at $22,000 and Coinbase has it at $22,010, this arbitrage opportunity will give you an instant return on investment of 0.045% (if done right).

Is crypto arbitrage an effective way make a profit?

Speed of executing the trade, although very crucial, is not the only factor. To make a profit effectively from crypto arbitrage, you need to factor in other ingredients:

- Exchange fees

- Slippage

- Price impact

If an arbitrage trade involves centralized exchanges like Coinbase or Binance, the exchange fees will usually eat up the majority of your potential profits, if you’re not careful. Generally, this is how a simple binary arbitrage works with centralized exchanges. In this example, we’ll use USDT and BTC.

1. Deposit lots of money

You need a significant amount of capital on both exchanges. For example, $5000 on Coinbase and $5000 on Binance. You’ll also need $5000 worth of Bitcoin on both exchanges. In total, your starting capital is $20,000. You need to buy Bitcoin from both exchanges at the same time.

2. Track prices on both exchanges

If you see a significant discrepancy, plan your trade. Let’s say that on Binance, Bitcoin has a spot price of $22,453 while on Coinbase, the spot price is $22,463. There’s a $10 potential profit on each Bitcoin.

3. Buy on one exchange

If you buy $500 worth of Bitcoin on Binance at this price, you’d have 0.02226873 BTC.

4. Sell on the other exchange

Please note that you’re not moving the Bitcoin between exchanges. Instead, you’ll keep the Bitcoin on Binance. However, you then need to sell exactly 0.02226873 BTC on Coinbase at its current price on that exchange ($22,463). You will get $500.22, at $0.22 of profit, or 0.0445%.

From this, see that even though none of your assets moved across exchanges, you’re $0.22 richer on your balance sheet. Note that by buying on Binance and selling on Coinbase, you’re indirectly causing the price difference between the exchanges to close. Chances are, you’re not the only one making this trade.

5. Do the reverse when the time comes

At some point, the price of Bitcoin on Binance becomes more expensive than on Coinbase. This allows you to arbitrage back — buy on Coinbase and sell on Binance. Let’s say that you’re buying $500 of BTC and selling 0.02226873 BTC, just like before (but in the opposite direction). You’d be getting $0.22 of profit again.

Be careful of running out of funds on exchanges. It’s possible to run out of USDT on the exchange where you need it the most. It can be tempting to transfer USDT to the exchange account that lacks it. Note that if you withdraw crypto, you’re going to get quite a hefty charge from each exchange.

A single transfer could wipe out all your profits. So, this is why it’s important to make small purchases. Yes, you started with $20,000 in capital, but it doesn’t mean you should use all $5000 of USDT to buy Bitcoin in that previous example.

Should you do crypto arbitrage on decentralized crypto exchanges?

On decentralized crypto exchanges, you can literally move your assets from one exchange to another. That’s because when you buy or sell crypto on DEXs like Uniswap or Sushiswap, assets move between the exchange and your wallet. Trading fees are usually very minimal, so why not do crypto arbitrage on decentralized exchanges?

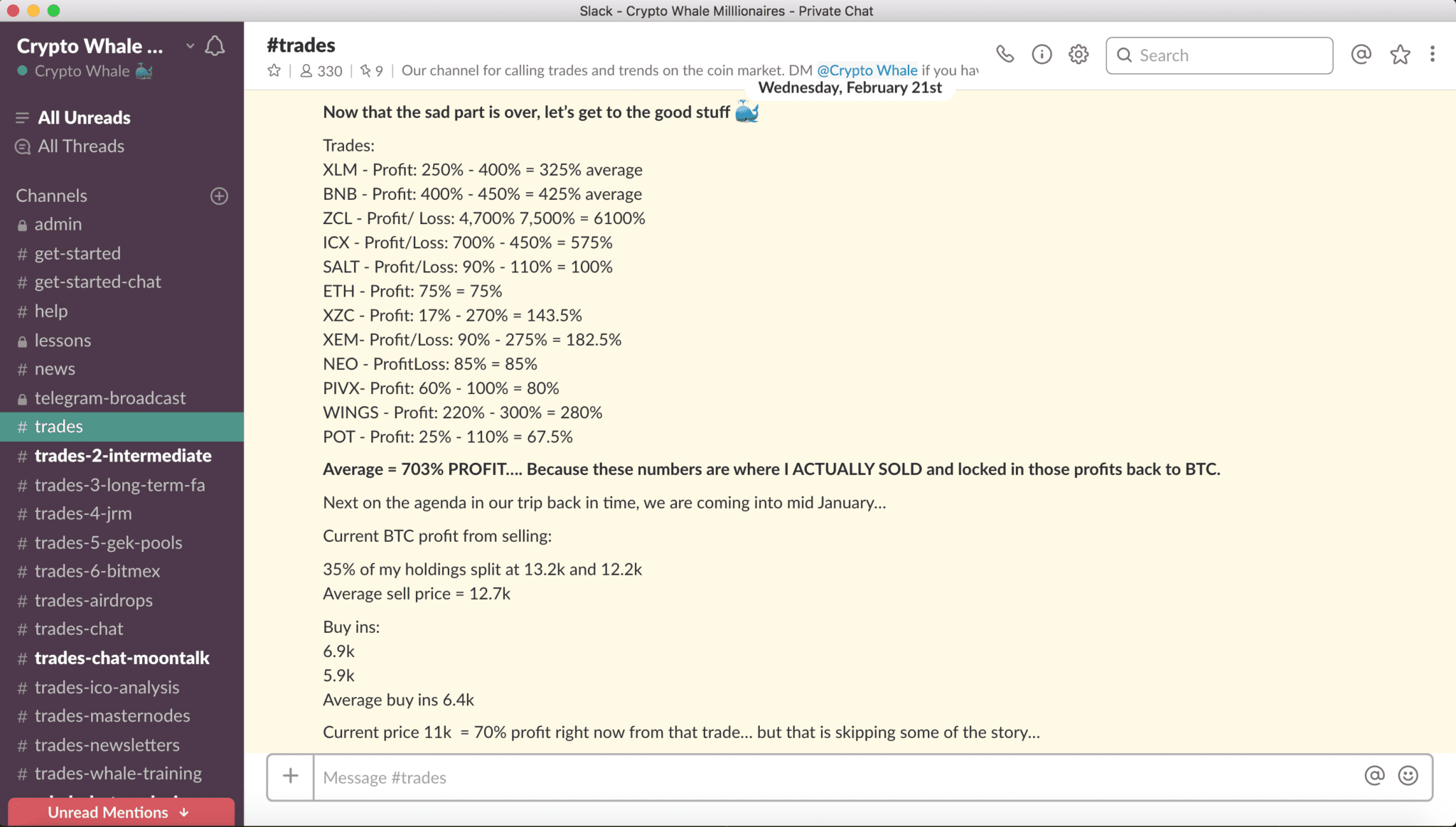

You can do it for sure. However, you must do so in small volumes, frequently. A special type of fee exists on decentralized exchanges that do not exist on exchanges like Binance or Coinbase. This fee is called price impact. This is the reason why whales (accounts with large crypto holdings and transaction volumes) make smaller transactions in succession.

The bigger the volume of your transaction, the larger your impact on the liquidity pool. And pools on DEXs pose a fee on large single transactions. This could go up to as much as 5%, meaning your marginal profit margins could get eaten up if you’re not careful.

The takeaways

Crypto arbitrage can be an effective low-risk form of trade for those with a much more advanced understanding of how crypto markets work and calculating their risks. Those who has access to tools like automated trading bots can also greatly benefit from crypto arbitrage trading, as it offers passive income.

Of course, you can gain access to information without getting those tools, for the purpose of trading. Blockcircle provides high quality trading signals based on powerful big data analytics tools for an affordable price. Check out what others have said about Blockcircle.

Blockcircle was founded in 2017 and has experienced two peak crypto bull markets in 2018 and 2021. These two periods of time have been a chance for many ordinary people to generate wealth, and become financially secure.

To learn more about what we can do for you, visit blockcircle.com.