Crypto shorting, also known as short selling or simply “shorting,” is a trading strategy used in the cryptocurrency market (and other financial markets) to profit from the price decline of a specific cryptocurrency. In essence, shorting allows traders to make money when the value of a cryptocurrency goes down.

But how is it possible for traders to make money when prices are declining? In this guide to shorting, we’re going to take a closer look at how it works, and whether or not it’s a good strategy.

How does crypto shorting work?

In principle, crypto shorting involves borrowing, selling, and buying back the assets to close out their position. Here are the general steps of crypto shorting:

- Borrowing Crypto: The trader borrows a certain amount of cryptocurrency from someone else (usually a broker or an exchange).

- Selling Crypto: After borrowing the cryptocurrency, the trader sells it on the open market at the current market price. This step is executed with the expectation that the price of the cryptocurrency will decrease in the future.

- Buying Back at a Lower Price: If the trader’s prediction is correct, and the price of the cryptocurrency does indeed drop, they can buy back the same amount of cryptocurrency at a lower price than what they initially sold it for.

- Returning the Borrowed Crypto: The trader returns the borrowed cryptocurrency to the lender (broker or exchange). The difference between the selling price and the repurchasing price, minus any fees or interest, represents the trader’s profit.

- Risks and Losses: It’s important to note that if the price of the cryptocurrency rises instead of falling, the trader will incur losses. They would need to buy back the cryptocurrency at a higher price than they sold it for, resulting in a loss.

Where can traders short crypto?

Traders can engage in shorting cryptocurrencies on various online cryptocurrency exchanges and trading platforms that offer margin or derivatives trading services. These platforms provide traders with the ability to borrow and sell cryptocurrencies they don’t own, essentially going short on the market.

Crypto shorting on Centralized Exchanges

Many well-known cryptocurrency exchanges offer margin trading services, allowing traders to short cryptocurrencies. These exchanges typically provide a variety of trading pairs that include major cryptocurrencies like Bitcoin, Ethereum, and others. Traders can use borrowed funds to open short positions on these platforms, often with leverage, which allows them to amplify their potential profits or losses.

Crypto shorting on Decentralized Exchanges

You may wonder if it’s possible to short crypto using decentralized platforms. While you can’t trade crypto you don’t own, as in derivatives trading, it is still technically possible to short crypto assets on decentralized exchanges. You need to find a way to borrow crypto against collateral, usually your stablecoins.

For example, if you post 1000 USDT as your collateral, you’d usually be able to borrow about $750 worth of Ether, for example. If you then sell the Ether in the open market to get $750, and then you buyback $700 worth of Ether after its price falls 6%, you’d make a profit of $50.

Remember to return the Ether you borrowed to the same decentralized crypto loan platform to unlock your 1000 USDT collateral.

How much can you profit from shorting?

Shorting is typically done as a short-term trading strategy — to “squeeze in” extra profits from a declining crypto market (also known as a bear market). A short trade is typically (and quite literally) a “short” trade, for assets that typically perform over a longer period of time.

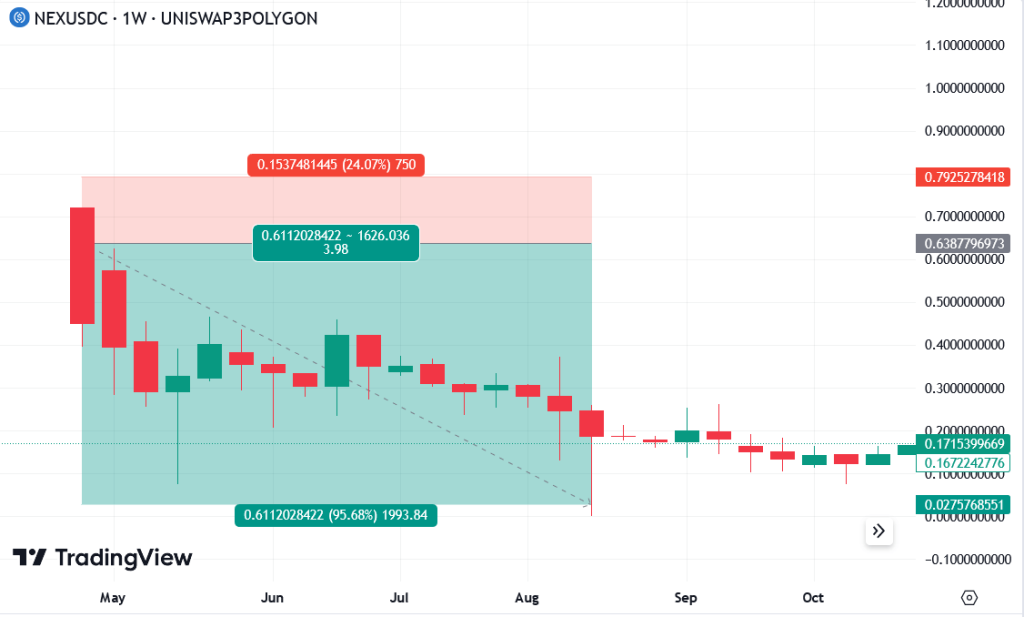

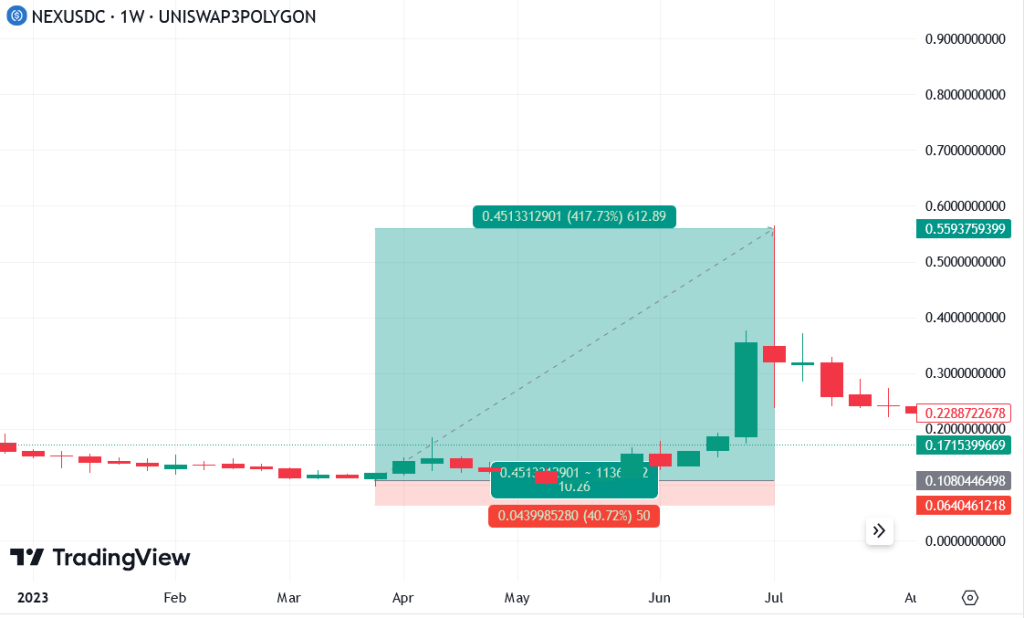

It’s important to note that the potential profits from shorting are not unlimited and are determined by the extent to which the price of the cryptocurrency falls. The greater the price drop, the more significant the potential profit. However, prices can only drop so low.

The theoretical maximum that a price can drop is down to zero. Whether it’s a drop from $100 to $0, or from $200 to $0, anyone shorting the asset (without leverage) will only be able to get as close to 100% ROI off of this trade — and no more than that.

On the other hand, someone who trades long from, say, $0.1 will experience 400x of their initial investment if the asset price goes up to $0.4, and that is without leverage. In a ranging market, your long positions will generate more profit potential than your short positions.

Therefore, precaution must be taken when engaging in shorting. You should carefully evaluate your risk tolerance and think about how much you’ll get out of a short trade for the certain amount of risk and effort you’re putting in.

Furthermore, traders should be aware of the fees associated with shorting on various platforms, including borrowing costs and trading fees, which can eat into potential profits. Leverage, while it can amplify gains, also increases the risk of substantial losses. As such, it’s crucial for traders to manage their leverage responsibly and not overextend themselves.

The takeaways

In summary, while shorting offers the potential for profits in a declining market, it is not without risks, and traders should approach it with caution, proper risk management, and a thorough understanding of the market dynamics.

If you try to short the crypto market blindly, it can feel like trying to make an espresso out of spent coffee grounds. However, with some help from a community of long-time traders and gem hunters, you can trade with more confidence.

Join Blockcircle’s Discord community and find your channel and trading style that fits you best. Learn more by visiting our Pricing and see what we have to offer.