Want to learn more about cryptocurrency (or “crypto“) but don’t want to read an entire encyclopedia? Here’s your guide to cryptocurrency basic knowledge, presented without all the tech jargon.

Cryptocurrency: The Basics

Cryptocurrency is a new type of asset that doesn’t exactly fit into the traditional assets category. As you know, traditional assets consist of things like company equities and debt, shiny commodities like gold, silver, copper, and dull but crucial commodities like wheat and crude oil.

Forex currency, also known as “fiat currency”, is also a type of traditional asset, specifically commodities not derived from nature. But if you ask if cryptocurrency is classified as a currency, then the answer would be “yes, but not in a traditional sense”. Here is why crypto is a “type of currency“:

- Crypto holds some value and is traded in an interconnected global market.

- Crypto can be exchanged for real-world goods and services.

- Crypto can be directly sent and received between two persons or entities, like cash.

- Crypto is issued at a rate and method based on the rules specified by the issuer.

All this is what makes cryptocurrency a type of currency. However, that’s where the similarities between crypto like Bitcoin and the US dollar end. The differences between crypto and fiat currency are plenty:

- Crypto is not issued by a government, nor an agent related to that government, such as a central bank.

- Crypto is not recognized by governments as currency and legal tender (with the exception of El Salvador, but only for Bitcoin).

- Crypto’s supply and issuance rate is controlled by computer programs.

- Crypto “accounts” cannot be frozen like traditional bank accounts.

- Unlike bank transfers, crypto transactions don’t require approvals from within and related banking networks.

- Crypto transactions and accounts are also pseudonymous, which means they’re represented by a random string of letters and numbers, not actual names. Unless publicly identified, they protect ordinary users’ privacy to a high degree.

To someone who is skeptical at the idea of cryptocurrency, crypto might be seen as “magic internet money” that holds no real value. In the next section, we’ll explain why crypto is valuable, and where that value comes from.

Why does crypto have value?

To answer this, it’s important to first realize that not all crypto are created equally. While some cryptocurrencies are made to solve real-world problems (and are valuable because they succeeded in doing so), some other cryptocurrencies were made for scam.

Crypto that solves real-world problems will not be easy to be dismissed, and will have some value greater than zero. To prove this, we can take a look at Bitcoin, the world’s first cryptocurrency. Bitcoin was invented to solve one problem — our over-dependence on the banking system for transferring value from one person to another.

Bitcoin’s program allows an individual to hold certain amounts of Bitcoin independently. This is in great contrast to the money held in bank accounts, which can be frozen or misused. In less developed economies, banks could collapse for “unknown reasons”, where in reality, they’ve had mishandled customer funds that had caused them to have liquidity issues and not being able to fulfill cash withdrawals.

Bitcoin has held the promise of banking independence since 2009. No one has been able to hack the network and manipulate Bitcoin transaction records due to extremely secure cryptography. Bitcoin’s cryptography depends partly on the use of high energy. Since energy is both valuable and scarce, Bitcoin’s price therefore reflects the value derived from utilizing high energy to secure the Bitcoin network.

The price of Bitcoin used to be less than a cent, but as more people recognize Bitcoin’s value contribution to the world of finance, its price became very expensive. You could see for yourself that although Bitcoin’s price is extremely volatile, it has never gone back to its initial price in 2009.

Does crypto behave like stocks?

To reiterate, different cryptocurrencies are invented for different purposes. Some cryptocurrencies behave kind of like company equities, or “stocks”. Let’s briefly highlight what it means to invest in a stock:

- You own a portion of a company’s equities.

- If you own a significant portion of company equities, you’re entitled to making important decisions, or your vote will have greater weight.

- You’re concerned with the company’s performance.

- You could receive money from annual dividends.

- The amount in dividend paid depends on company profitability and stakeholder decisions.

- You gain access to public data concerning the company’s financial statistics.

You will find that some crypto behave like traditional stocks. For example, Aave is an organization that lends out stablecoins and crypto. Stablecoins are essentially crypto whose value is always almost equal to an underlying real-world asset, for example 1 USD = 1 Tether USD (USDT).

To borrow 100 USDT from Aave, a borrower must post their own crypto as collateral. Usually, the collateral is at least 125% of the borrowed amount. The borrower must also pay interest. The interest fee is paid out to depositors who lent out the stablecoins (or crypto) in the first place.

In addition, fees are also paid out to Aave’s native token holders who locked AAVE tokens into a special crypto “vault”. AAVE token holders also have the right to vote on, for example, changes to the interest rate and the required collateral amount.

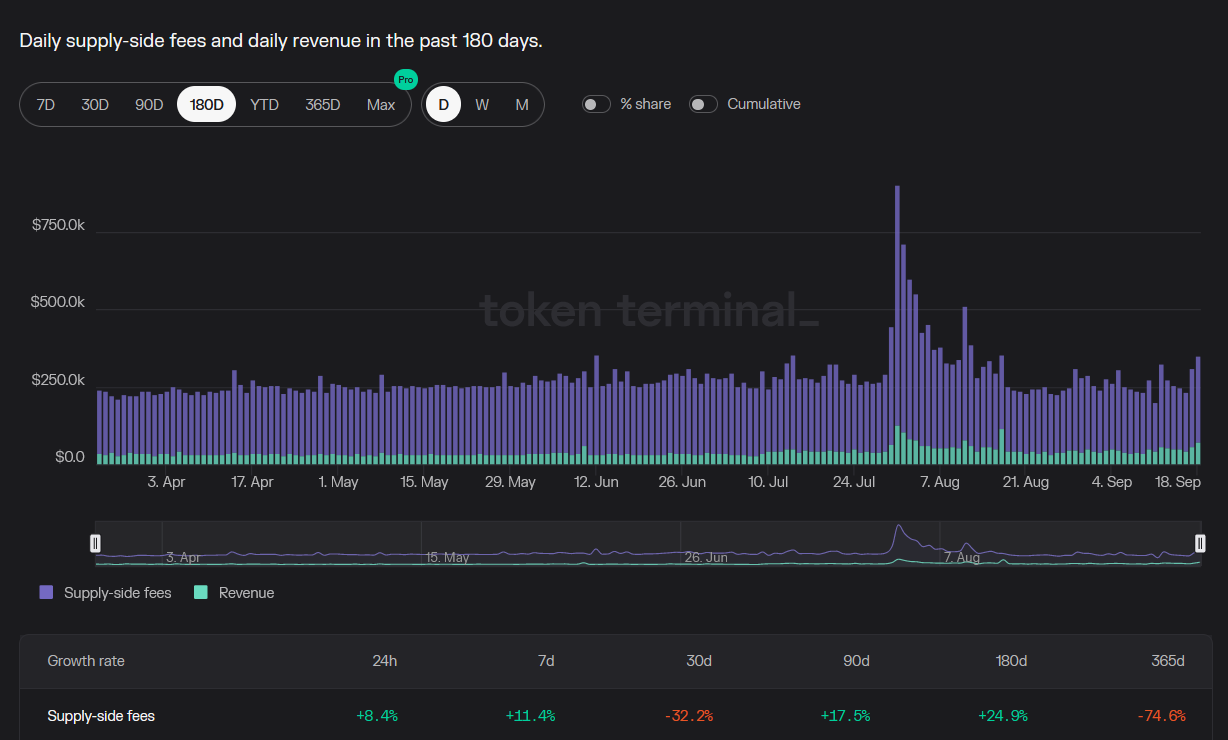

You can see that this system is starting to look like a bank, and you can even say that investing in AAVE tokens is like investing in a particular bank. Furthermore, you can always check out the financial statistics of the Aave platform for free, as it is publicly available.

Why are crypto prices so volatile?

Crypto prices are volatile for the same reason why penny stocks in the market are volatile. Compared to traditional stocks, there aren’t as many individuals invested in crypto. This means that it’s relatively easy for prices to change abruptly when a particularly large investor buys or sells that crypto.

You can prove this by looking at the volatility of Bitcoin (BTC) versus, say, Aave tokens (AAVE). There are a lot more Bitcoin owners than Aave token owners, and therefore the price of Bitcoin is more stable relative to Aave tokens.

Now, do not make the mistake of judging a crypto project based on its volatility in the market or how pricey one unit of that crypto is. There are so many reasons why investors have been selling crypto, which results in falling prices. Factors outside the crypto project, like the current macroeconomic state, have had such a great impact on the overall crypto market.

However, you should also learn to discern between crypto projects based on available public data. For example, you could see how many people are actually using Aave’s lending platform, or see how many people are interested in holding Bitcoin as a long-term investment.

All of these factors are fundamental reasons why a crypto project is valuable, regardless of the current market situation. Remember, had Warren Buffet sold Coca-Cola during the DotCom Bubble or the 2008 Financial Crisis, he wouldn’t be as rich as he is today. Rather than panicking like everyone else, Buffet recognized the value of the companies he invested in, and stuck through the hard times in the market.

The key takeaways

Cryptocurrency is a new type of asset, but it does share a few of its qualities with government-issued fiat currency and traditional company equities. Crypto’s value is derived from many things, but the bottom line is that if it solves real-world problems, it would hold a value that is always greater than zero.

Crypto can behave like company shares, where you could earn passive income from fees extracted from the platform that issues that cryptocurrency. Because some crypto behaves similarly to company shares, it’s often a good idea to think like a stock investor.

That is, to find value based on public data, and to not be easily swayed by temporary market conditions. Of course, which crypto to buy, how many and how long to hold depends on the risk tolerance of individual investors. Some investors only day trade cryptocurrency, and don’t hold them overnight.

Always adapt a strategy to your unique requirements, and always trade wisely!