In the Ethereum network, every operation, whether it’s sending Ether (ETH) from one address to another or executing a smart contract, requires computational resources. These resources are not free, and the network charges users for utilizing them. This is where gas fees come into play.

Gas fees are also known as network fees. You pay Ethereum validators to incentivize them to include your transaction in the next block. Gas fees are also essential for the security and efficiency of the Ethereum network. The concept of gas fees ensures that the network remains resilient against spam and abuse while fairly compensating validators for their computational work.

In this article, you’ll learn primer concepts about Ethereum gas fees, how to track them using a gas fee tracker, how they are calculated, and answer common questions such as “why are gas fees so expensive on Ethereum?”

How gas fees are calculated on Ethereum

Gas fees are not fixed, nor are they constant for every operation. Before knowing how they are calculated, it’s useful to know about concepts like gas limits, base fee, and tips, as well as what a ‘gwei’ is.

Different operations use up different units of computational resources, which we refer to as gas. A simple ETH transaction will require 21,000 gas (a minimum gas limit of 21,000 is required). But how much that is going to cost in dollars or ETH will depend on how much 1 gas costs.

The price of a single unit of gas is usually denominated in Gwei (or giga-wei). A Gwei is a subunit of ETH, so 1 ETH equals 1 billion Gwei. The base fee is the minimum cost of gas that is algorithmically calculated by the entire Ethereum network, and it changes from day to day.

Let’s say that on a given day, the base fee is 10 Gwei/gas. Sending some ETH requires 21,000 gas. So, the transaction fee for sending ETH on that day is 10 Gwei/gas * 21,000 gas, equal to 210,000 Gwei. Since 1 Gwei is 1 billionth of 1 ETH, 210,000 Gwei equals 0.00021 ETH, or roughly 47 cents in December 2023.

What’s all the fuss about Ethereum gas fees when it’s supposed to cost 47 cents to do simple transfers? Well, that’s because we haven’t accounted for the priority fees, also known as a tip, given to validators in order to give them incentives for including the transaction on the next block.

Not paying a tip can mean your transaction will be stuck in the memory pool indefinitely, so crypto wallets often suggest sending a “standard” priority fee as the minimum. Priority fees can range from 2 to 5, but at times when the network gets so congested, it could get up to 100!

Finally, taking into consideration the priority fee, our formula for determining the gas fee is as follows:

Gas fee = gas limit * (base fee + priority fee)

Considering the above factors, it was possible for the gas fee for executing a simple transfer to reach upwards of $40 (in 2022).

What are some gas limits for different computations?

Here are some examples of operations and their associated gas costs in Ethereum:

Sending Ether (ETH):

A basic Ether transfer between two accounts consumes a certain amount of gas. For example, it might cost around 21,000 gas. Let’s use the same factors from the above calculation to give it a meaningful USD cost of around 50 cents.

Smart Contract Deployment:

Deploying a new smart contract onto the Ethereum blockchain requires more gas than a simple Ether transfer. The exact gas cost depends on the complexity of the contract’s code and its constructor function. It can range from thousands to millions of gas. Given everything is equal, this is equivalent to hundreds of dollars in fees.

Smart Contract Function Execution:

Executing a function within a deployed smart contract consumes gas. The gas cost depends on the complexity of the function and the amount of computational work required. For example, a simple function might cost 100,000 gas, while a more complex one could cost 1,000,000 gas or more.

Data Storage:

Storing data on the Ethereum blockchain, such as writing to a contract’s storage, incurs gas costs. The cost depends on the amount of data being stored and the number of storage slots being updated.

It’s worth noting that Ethereum’s gas fee wasn’t always this expensive. Hence, in the past, developers had the freedom to create programs without even considering its gas usage efficiency. Nowadays, Ethereum developers have to try to optimize their dApps multiple times in order to make them scalable for end-users.

Why is gas so expensive on Ethereum?

Ethereum is a work in progress, and its current version uses pretty much the same architecture as when it was launched, minus the change in consensus algorithm, which is now using the less energy-intensive Proof of Stake.

Network congestion is still rampant because Ethereum’s creators did not expect it to be so popular. Even though newer alternative networks exist, such as Polygon, Solana, and Avalanche, Ethereum is still far more popular and is still very much in use today for various applications — trading, decentralized finance, NFT creation, and data storage.

It’s worth noting that gas fees appear to be expensive now because Ether has also become expensive. Today, 1 ETH costs upwards of 2000 US dollars. In the past, when it was just costing $1, deploying and executing smart contracts cost a fraction of a fraction of a penny — it was virtually a free cloud service.

How do I track Ethereum gas fees?

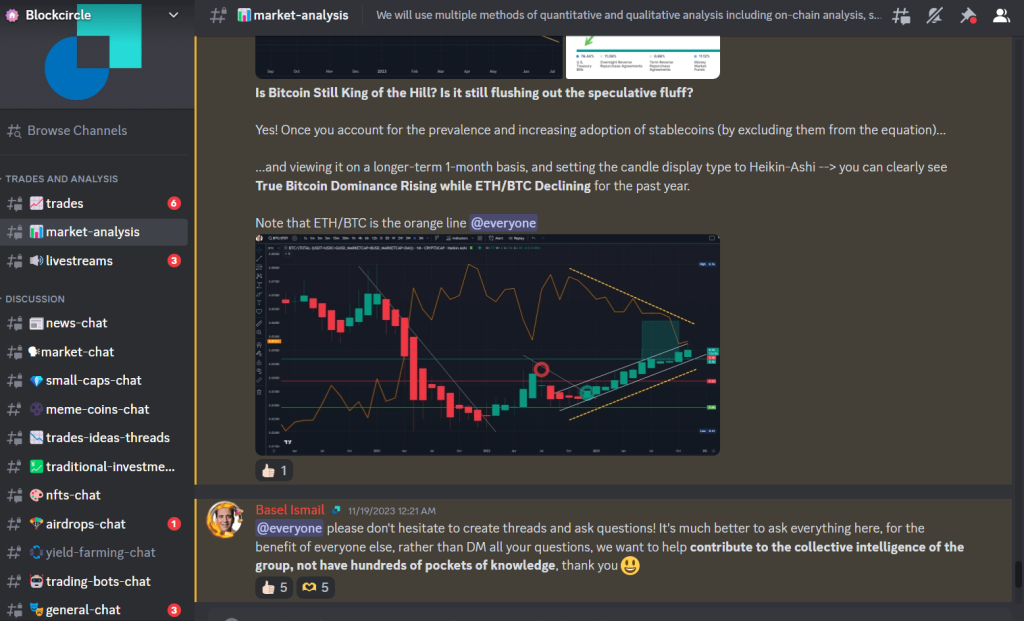

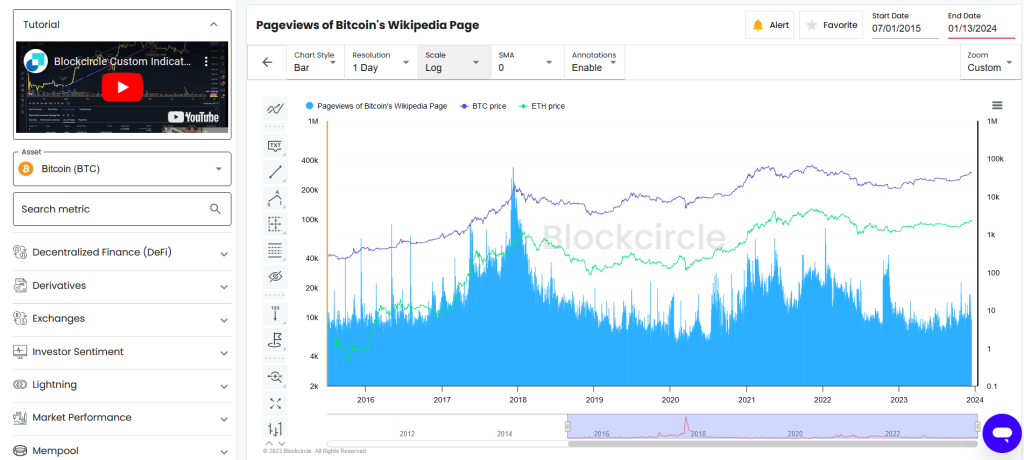

You can easily keep track of Ethereum gas fees using Blockcircle’s gas fee tracker. Head over to Blockcircle, and go to Tools > Charts. You should see this UI on your browser.

See the Bitcoin (BTC) on the Asset dropdown? Find Ethereum and search for “fees”. Click on “Fees (Mean)”. The chart below is your Ethereum gas fee tracker. The gas fee is denominated in ETH, and you can scale back as far as August 2015 when the data first became available.

The cool thing about this chart is that it compares the price of ETH and BTC, showing you how the three metrics are correlated. If you zoom in, you can even catch data resolutions of up to 24 hours as you study how daily gas fees peak.

Did you know? You can use this gas fee tracker to predict whether there will be a lot of trading activity in the next hour. Trading on Ethereum requires large amounts of gas, and gas fees tend to spike when traders are trying to outbid each other in an attempt to put their trading orders on the blockchain.

Whether the market is about to explode or take a plunge, spikes of gas fee are indicative of big price action in the foreseeable future.

Gain access to 100+ charts at Blockcircle!

Join Blockcircle today and get a free 7 day trial on all the charts that have helped us make smart trading decisions for years. If you’d like to chat with market experts on Discord and catch lucrative but mispriced crypto assets together, you can learn more about it in our Pricing page.