Automated trading algorithms, also known as “trading bots”, are designed to help professional traders monitor and discover potentially profitable trading opportunities. Automated trading algorithms in the context of cryptocurrency are trading bots that monitor the crypto market for the same purpose.

In this article, we’ll be introducing what automated trading algorithms are, how they work, and discuss their reliability. This article will not cover any procedure on how to create and use automated trading algorithms, as this is something more advanced that beginners don’t need to know for now.

What can automated trading algorithms do?

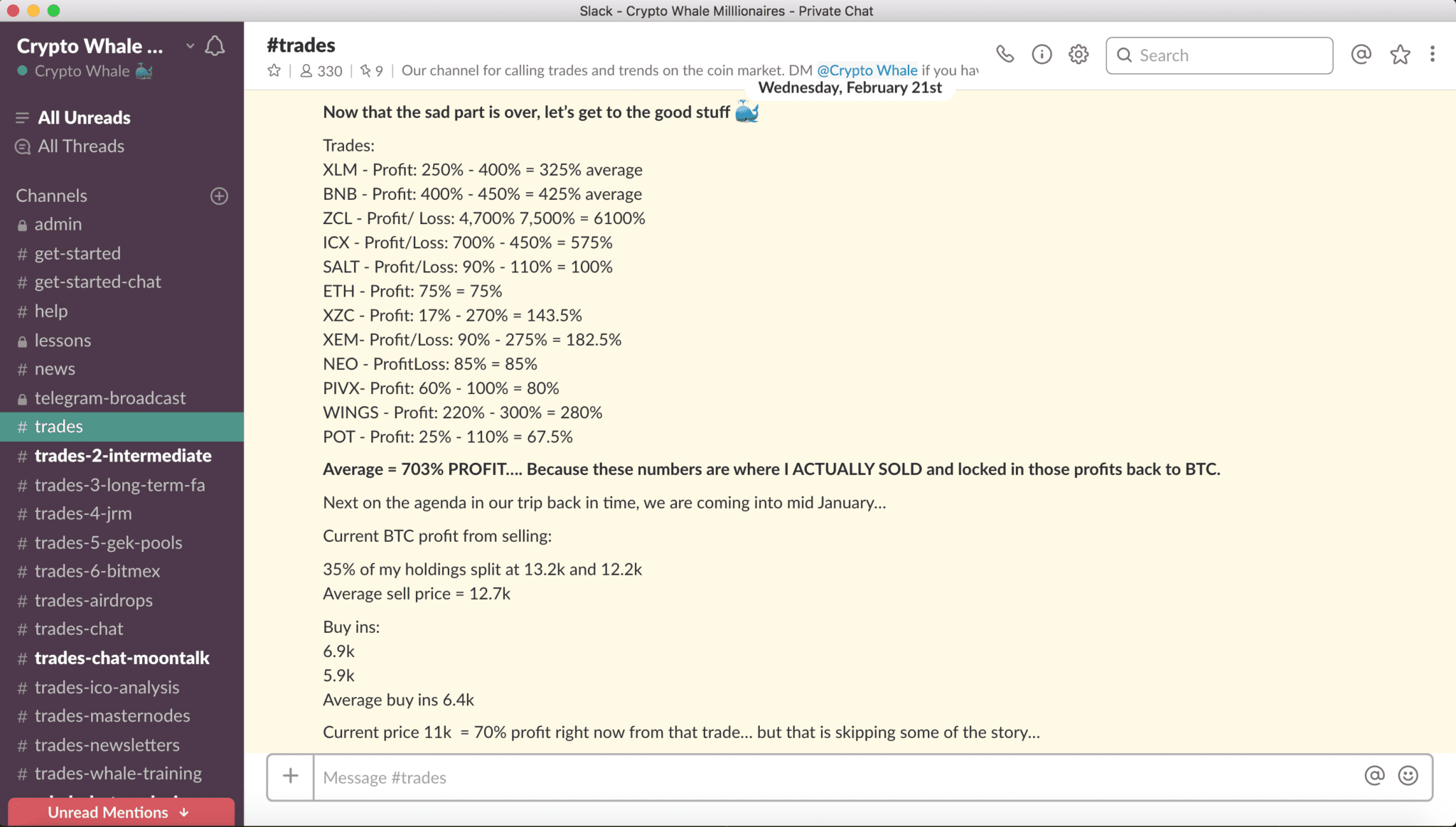

Automated trading algorithms are nothing but code and software, so anyone with the know-how can build them, and even sell them to the general public. However, the popularity of trading bots and trading algorithm services gives it somewhat of a strange reputation.

Many people think that trading bots can do everything that a professional fund manager could do, such as choosing assets to trade, managing risks, diversifying, and actively rebalancing the portfolio. Although some automated trading bots can be programmed to aid in such activities, they are not (at least from now) a substitute for professional analysts, traders, and portfolio managers.

Many people have fallen victim to so-called bot trading services. They thought that trading bots can simply take their money and if investors give them time, the bots can multiply their money as programmed. Of course, this is the wrong type of mindset — trading bots are not a “set-and-forget” solution.

So, if someone were to offer a “bot trading service”, ask lots of questions — there can’t be too many questions.

How do automated trading algorithms trade crypto?

Now, we can talk about what automated trading algorithms are good at — monitoring the crypto market and recognizing trading opportunities. The simplest trading algorithm can be a program that monitors how the prices move in relation with two or more moving averages.

Take the below chart as an example. On the MATIC/USDT market, we’re providing our bot with three additional data to measure, Simple Moving Averages (SMA) — SMA20, SMA50, and SMA200. These moving averages move at different paces, but you can immediately notice that their positions relative to one another can change.

For example, at one point, the SMA20 (green) is under the SMA50 (yellow) line when the market moves downward. Using this principle, we can program the bot to look at crossing events when the green and yellow lines cross and swap positions to indicate a change in trend.

There are two types of crossing events on this chart — “smaller” and “larger” ones. The large crossing event is indicated by a fast crossing of the red (SMA200), orange, and green lines, showing a stronger trend and a lucrative trading opportunity. The red and green spin symbols represent their directionality — bear (red) or bull (green), which have been manually added and are not part of the standard TradingView settings.

Obviously, we’d want to trade during fast price actions, so that there’s a much smaller chance of getting our prediction wrong. The problem is that these crossing events don’t always occur when we’re awake.

Due to the fact that the crypto market is open 24/7, we could miss these lucrative trading opportunities. That’s where the trading bot comes in. It’s awake for 24 hours, and should be able to execute the correct trades at the right time.

How to improve automated trading algorithms?

The great thing about trading bots is that they can potentially be trained to conduct much more accurate technical analysis. Using artificial intelligence, they could learn from their mistakes and other bots’ mistakes. They can also conduct backtesting — a practice of using past price data as a model to create new rules for future trading.

Of course, the crypto market doesn’t always behave according to its past behavior. This is because technical analysis ignores factors outside the chart. The economy, social sentiment towards crypto, and the actions taken by important leaders of a crypto project, could very much affect the assets’ valuation. Despite this, apart from the occasional external influences, trading bots have been shown to be reliable, as they can monitor the market non-stop, and trade without emotions.

There are also more ways to improve trading algorithms. For example, they can help traders decide how much money to risk based on the probability that the trade will go wrong. In volatile periods, technical indicators are less likely to help trading bots make good trading decisions.

Therefore, trading bots should also recognize when not to trade.

Can you trust automated trading algorithms for crypto?

The previous section claims that trading bots have been reliable for monitoring the market non-stop, and trading without emotions. But whether or not it is reliable as a passive income stream is entirely a different question.

A profitable trading bot will obviously need to have a higher success rate than its failure rate, at any period of the crypto market cycle. Oftentimes, failure is not so much because the bots lack the data to create high quality trades. Rather, high quality trades depend on high quality risk management.

At this stage, risk management is still something that trading bots need extra help with, and without a professional technician’s intervention, it’s likely that trading bots will run out of cash to trade with, in the long run.

So, trusting automated trading algorithms for crypto requires that you trust two things:

- You trust and understand the algorithm being used to execute trades.

- You trust the technician to help the bot trade effectively.

Like we’ve said before, trading bots are not “set-and-forget” solutions, and you’ll need to be prepared to put your trust in a human and a machine.

The third option — Use crypto trading signals

If you’re still not comfortable with that fact, there’s a third option: crypto trading signals.

Crypto signals are trade recommendations generated by analysts using technical and fundamental analysis to identify potentially profitable trades in the crypto market. The word “recommendation” implies that the trading signal service you subscribe to will give you the trading advice, but ultimately, you make the call.

Generating crypto trading signals can be complex and requires a high level of understanding of the market and technical analysis. Furthermore, market sentiment analysis is essential for making informed decisions based on holistic data collection.

This is why crypto trading signals must be created and led by professional technicians who have access to data and statistical tools. Professional crypto trading signals can still definitely use the aid of automated trading bots to do what they do best. However, the bots don’t make the call. Instead, you do, as you have full control over your money.

We think this is many times better than delegating a service with your hard-earned cash and having to trust their machines and the people running holding onto your money.

Blockcircle can help you trade like a pro

Blockcircle is a private trading and investment management community of computer scientists, quant traders, financial engineers and executives that come together to combine all their skills and experiences to create high quality trading signals.

To give you a picture of how we work, we have sub-teams that focus on different aspects of the crypto market. We look for undervalued gems based on fundamental analysis, new token offerings on various centralized and decentralized exchanges, use off-chain and on-chain analytics, web traffic analytics, as well as the reliable and traditional technical analysis.

The group was founded in 2017 and has experienced two peak crypto bull markets in 2018 and 2021. These two periods of time have been a chance for many ordinary people to generate wealth, and become financially secure.

To learn more about what we can do for you, visit blockcircle.com.