There is a release of the Personal Consumption Expenditures report on Friday and the U.S. Federal Reserve constantly reminds that interest rates will likely increase some more. However, major cryptocurrencies including Bitcoin have shown limited responsiveness to major macroeconomic events.

It seems that the crypto markets do not exhibit the usual level of reactivity to macroeconomic news. This is likely due to the fact that these kinds of news have been “priced in” — the market has settled on a price a while before the actual release of the news. For instance, recent inflation and GDP data had only a marginal impact on Bitcoin, causing a mere -0.74% and 1.16% fluctuation range.

At the time of writing, Bitcoin is trading near $29.2k, breaking through the 20-day moving average as its multi-week resistance line.

In the meantime, crypto markets in the region exhibit minimal movement in the Asian regions. Likewise in Asia, the cryptocurrency market currently lacks a clear narrative regarding the utilization of traditional institutions for a Bitcoin ETF.

Awaiting regulations on Bitcoin spot ETF

Some experts also suggest that a potential spot Bitcoin ETF could serve as the catalyst needed to propel Bitcoin’s market trend growth. Mao Shixing, the co-founder and CEO of custodian Cobo, believes spot Bitcoin ETFs could be a game-changer. ETFs are an alternative way for those with significant liquidity to fund the crypto markets in a way that is less risky and more convenient.

It was said that the launch of just one or two ETFs with significant liquidity could reintroduce compliant funding channels in North America, bringing more money into the crypto space. Spot ETFs are expected to be approved by Q1 of 2024, according to a few traditional institutions familiar with the matter.

If realized, this approval could trigger a rally similar to the one experienced in 2021 and 2022 when Grayscale’s influx of US dollars catalyzed a significant Bitcoin rally. While the long-term outlook is exciting, however, Vivien Fang (head of financial products at Bybit) said it is still premature to declare a bull market.

Yet, the current price ranges present a period of attractive accumulation opportunities for those with a long-term goal in mind.

Is the crypto market trending towards an “Alt Season”?

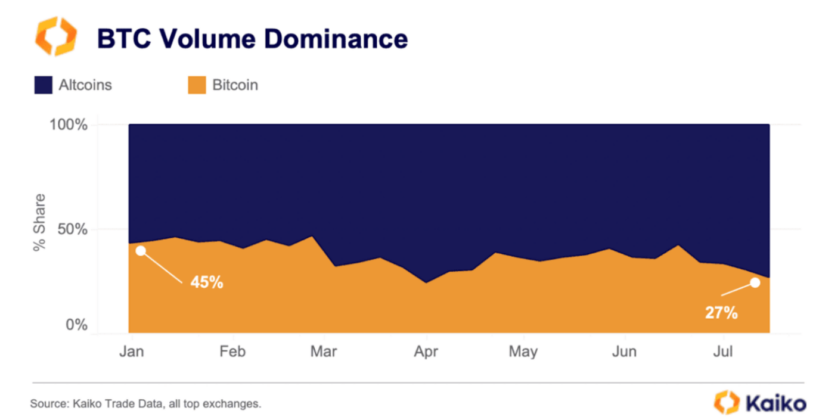

By the looks of things currently, the signs are apparent for an “alt season” crypto trend. The Bitcoin Dominance Index shows a decrease in dominance in the past year, prompting smaller cap coins to receive more dollar share and investor interest.

“Alt season” refers to a time period where investor interest lies in trading smaller cap coins rather than Bitcoin and Ethereum, resulting in their relatively more volatile price movement.

Speaking of altcoins, decentralized finance platform-specific altcoins are also undergoing a noteworthy resurgence. Elon Musk’s rebranding of Twitter as “X” is seen as a positive signal for the broader market, particularly DOGE — more below.

Elon “Dogefather” Musk rebrands Twitter, DOGE jumps

Dogecoin (DOGE) recently recorded its most substantial single-day gain in four months, surging by 10% on Tuesday. Within two weeks, its price has gained 25%, with speculation suggesting that DOGE might be adopted as a payment mechanism on Twitter’s rebranded platform.

Elon Musk is well-known to praise Dogecoin and the general crypto technology in public. The eccentric billionaire, having changed the iconic Twitter’s brand to having similarities to Musk’s former company, X.com, sparked some positive speculations.

One of which is Twitter’s potential integration of DOGE and other blockchains like Ethereum and Solana for payments. Of note, this would not be Twitter’s first foray into crypto. Under the former CEO, Jack Dorsey, Twitter has collaborated with payments startup Strike for a Bitcoin microtransaction feature, such as tipping.

In other news, several smaller cap assets are showing incredible gains, possibly due to the recent Ripple vs. SEC ruling, which is now in the crypto community’s favor, and some other developments in parallel.

Chainlink (LINK), for example, has seen double-digit returns this month due to the successful deployment of its Cross-Chain Interoperability Protocol, facilitating token and message exchanges across multiple chains.

Where’s the King of Crypto headed?

Bitcoin’s price experienced a slight dip, failing to maintain key resistance levels, leading one market analyst to liken it to the bear market observed in 2019.

Before 2020, Bitcoin displayed heavy corrections after reaching more than halfway towards its 2018 all-time high. Nevertheless, it regained strength following the third halving in May 2020, eventually witnessing significant growth as demand surged with the influx of inexpensive dollars during the 2020s.

While there are no guarantees of a repetition, it is plausible to consider that Bitcoin’s continuous rally in 2023 may not be sustained unless there is a significant catalyst, such as the approval of a BTC ETF.

Also read: Three signs Bitcoin could reach all-time high in 2025

The takeaways

The crypto market trends in July 2023 indicate a stable and resilient Bitcoin, showing limited responsiveness to macroeconomic events like inflation and GDP data. Bitcoin’s price is currently trading near $29.2k, and experts believe that the approval of Bitcoin Spot ETFs could be a game-changer for its long-term growth.

While Bitcoin remains stable, excitement surrounds altcoins, particularly Dogecoin. The potential integration of DOGE (and other cryptos) as a payment mechanism on Twitter’s rebranded platform has sparked significant interest, leading to a surge in its price. Moreover, smaller cap assets are on the rise due to the recent SEC v Ripple ruling.

Overall, the crypto market is witnessing a potential “alt season” trend, with investor interest shifting towards trading smaller cap coins rather than Bitcoin and Ethereum, prompting their relatively more volatile price movement. While Bitcoin’s future remains uncertain, the market awaits regulatory decisions on Bitcoin Spot ETFs to potentially drive further growth in the crypto space.